welcome@mpoweraccounting.com

| 01892 234353

Royal Entertainment

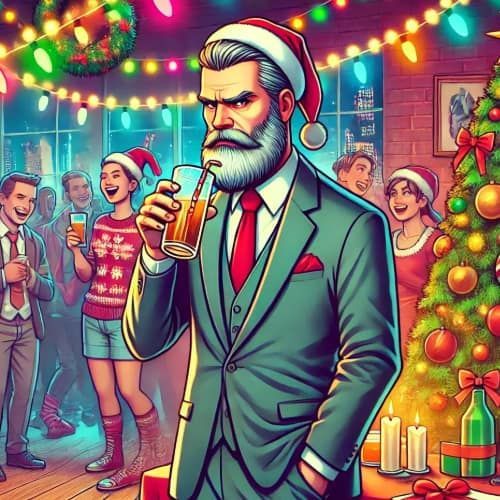

A right royal weekend of entertainment

Well, what a weekend that was! A royal wedding and the FA cup final, red white and blue; perhaps more blue than the other colours (that’s for you John). Personally, I loved the royal wedding and good luck to Harry and Megan. The weather was perfect and I’m sure that many of you, like myself, will have attended a party over the weekend to celebrate; it was certainly a weekend for entertaining but if you wanted to pass this off as a business expenses you would have run into some penalties, and we’re not talking about the football!

As a rule, non-staff entertaining is not allowable for corporation tax purposes. However, just because they do not attract a corporation tax saving doesn’t mean they can’t still be put through your company as a cost, which is usually better than paying for them out of your own pocket.

As with any business costs they must be wholly and exclusively incurred for the purposes of your business. If the meetings are not considered to be for ‘business purposes’ then HMRC can determine that the entertaining cost was incurred largely to benefit yourself as the director and as such should be treated as a taxable benefit in kind and attract personal tax and national insurance. And you do not want to have to complete a P11D return to the Revenue if you don’t need to.

The grey area here is what is considered to be business purposes and where a line can be drawn to distinguish between those entertaining costs that would qualify and those that would not. HMRC currently explain the differences between business and non-business entertainment as the below:

- business entertainment of clients – e.g. discussing a particular business project or forming or maintaining a business connection

- non-business entertainment of clients – e.g. entertaining a business acquaintance for social reasons

An example of an entertaining expense that would qualify for business purposes would be meeting a client or potential new client at a reasonably priced restaurant for a relatively inexpensive lunch to discuss a potential upcoming contract. In this scenario there should be no personal tax issues for yourself so long as reasonable records are kept to justify the expenditure, such as who you met and the reasons for the meeting. The lack of decent record keeping, in some scenarios, is likely to be the deciding factor should HMRC investigate. Employing the services of a properly qualified bookkeeper will ensure that your books will be kept properly so any questions by HMRC can be easily answered.

An example of an entertaining expense that may not qualify as a business expense would be meeting a client, who also happens to be a friend, at an exclusive restaurant with an a expensive wine list. HMRC may argue that this is excessive and there is a clear personal benefit to yourself and as such it should be treated as a taxable benefit. However, in true Revenue fashion, there is no clear guidance given, so it is largely down to the business owner to police and decide on a case-by-case basis; again, the advice of a professional qualified bookkeeper will be invaluable to keeping you safe.

I hope that you enjoyed your weekend, if only for the lovely sunshine and there’s no benefit in kind penalty in kind for that yet – just had to use the word penalty one more time (John)!

Let’s connect

2 Oast View

Horsmonden

Tonbridge

Kent TN12 8LE